Want to Launch Your Passive Income Business as a Side Hustle in the next 90 Days?

The Tools, Training, and Systems to Launch and Grow Your Solopreneur Business!

Grab our FREE: "Business Startup Checklist" So You Can Avoid Making The Same Mistakes We Made!

We'll Deliver Our Free "Business Startup Checklist" Immediately to Your Inbox

gosolo™ is committed to your privacy. We will occasionally send you free content and let you know about our offerings and you can unsubscribe at any time. We have never sold data and we never will. Your email address is safe with us.

Downloads To Help You Launch Your Solopreneur Business

These are just a few of the amazing solutions we have for solopreneurs, coaches, and consultants launching to a global market...

Business Plan Template

There has been a shift in branding in the last 10-15 years as personal brands have caught up with the importance of corporate branding. Building your personal brand has become more important than ever thanks to social media. If you want to stay relevant, then systematically organizing everything you do to build your personal brand will pay dividends in your bank account.

S-Corp Templates to Set up Your Corporate Structure

You'll get 3 S-Corporation Templates in Word Format so you can modify them to fit your needs. Each of the templates were used in the actual formation of subchapter S corporations. You'll also get a bonus sample Corporate By-Laws template

Cash Flow Expert Spreadsheet

Project, monitor, and manage your cash flow with our cash flow expert spreadsheet this is delivered as an Excel spreadsheet but it can be opened in Google Sheets and the Free Online version of Excel and any other software that can open Excel.

This PowerPoint template has every design you need to get your business start right. Use template to build presentations for investors, employees and even new clients. This template is delivered as a PowerPoint template and is easily modified to match your brand colors using the Free version of Office Online and any other software that can open PowerPoint files including Google Slides.

Top Software Tools for Solopreneurs to Run Their Business Online

Everything you need to manage your expert business at a high level to help you achieve your business goals are listed below. Check it out! We've done all the research and these are the tools we use!

Marketing Copy, Scripts and Blog Posts Written for You!

Do you ever get stuck in front of a blank screen when you have to write your marketing copy? What if all you had to do is answer a few simple questions and let AI write your marketing copy for you. You have to check this out.

Software for Creating eBooks for the Web, Kindle, and all Digital Publishing

If you have a book in you or you simply want to publish a kindle book or even an eBook, this software is for you! It will format your book to fit the standard ebook sizes and allow you to create an amazing cover because we all know that we do "Judge a Book By Its Cover" ;~)

CRM Software that can run your entire business online

With no technical skills, you can build a website, build a marketing funnel, connect it to scheduling your calendar, accept payments, automate client onboarding and workflow, automated emails, texting and it can handle your phone calls. It's like having an extra Full-Time Employee (FTE) and get this, for a limited time you can get it all for a low one-time fee!

Ever wondered how they make product graphics? Even if you have no graphics skills or talent you can still create amazing product graphics for your business with simple to use software that's cheaper than photoshop and better than canva.

Latest News and Stories ...

10 Best Accounting Tips for Solopreneurs

10 Best Accounting Tips for the Solopreneur

Introduction

Hey there, solopreneur! Embarking on a solo business journey is exhilarating, but it also comes with its fair share of challenges. One of the most daunting? Accounting. But fear not, we've got your back with some top-notch tips to keep your finances in check.

The Importance of Accounting for Solopreneurs

Why accounting matters

Accounting isn't just about crunching numbers. It's the backbone of your business, ensuring you're profitable, sustainable, and compliant with tax regulations. Plus, proper accounting gives you insights into your business's health, helping you make informed decisions.

The challenges of solo accounting

When you're a one-person show, managing everything from marketing to accounting can be overwhelming. Without the right strategies, it's easy to let things slip through the cracks, leading to potential financial pitfalls.

Top 10 Accounting Tips

1. Separate Business and Personal Finances

First things first, keep your business and personal finances distinct. Open a separate business bank account and credit card. This not only simplifies bookkeeping but also ensures you're not mixing personal expenses with business ones.

2. Invest in Accounting Software

There's a myriad of accounting software tailored for solopreneurs. Tools like QuickBooks or FreshBooks can automate invoicing, expense tracking, and tax calculations. It's like having a mini-accountant in your pocket!

3. Regularly Monitor Your Cash Flow

Cash flow is the lifeblood of your business. Regularly check your inflows and outflows. This helps in anticipating any financial crunches and planning accordingly.

4. Keep Detailed Records

Every receipt, every invoice, every expense – document it. Detailed records make tax time less stressful and ensure you're capturing all deductible expenses.

5. Understand Tax Deductions

Did you know that your home office or even business trips could be tax-deductible? Dive deep into tax deductions applicable for solopreneurs to maximize your savings.

6. Set Aside Money for Taxes

Avoid the year-end tax surprise. Set aside a portion of your income for taxes regularly. Consider opening a separate savings account just for this purpose.

7. Consider Hiring a Professional

Sometimes, it's worth investing in an accountant or tax professional, especially if your finances get complex. They can provide guidance, ensure compliance, and often save you more than their fees.

8. Stay Updated on Tax Laws

Tax laws evolve. Stay updated to ensure you're compliant and taking advantage of any new deductions or credits.

9. Revisit Your Business Budget

Budgets aren't set in stone. As your business grows and changes, ensure your budget reflects those shifts. Regularly revisiting and adjusting can help you stay on track financially.

10. Continuously Educate Yourself

The world of accounting and finance is vast. Continuously educate yourself, whether through online courses, workshops, or books. Knowledge is power, after all!

Conclusion

Accounting might seem daunting, but with the right strategies and tools, it becomes manageable and even empowering. By implementing these tips, you'll be on your way to financial success as a solopreneur. Remember, every business decision, big or small, is a step towards your dream. So, keep those numbers in check and keep soaring!

FAQs

What's the best accounting software for solopreneurs?

There are several options like QuickBooks, FreshBooks, Zoho Books, and Wave. The best one depends on your specific needs and budget but we use Zoho Books and it is Free until you get to $50k and you can upload your bank statements right into Zoho. It's Awesome!

How often should I review my finances?

Ideally, you should monitor your cash flow weekly and do a comprehensive review monthly.

Are all business expenses tax-deductible?

Not all. It's essential to understand which expenses qualify as tax-deductible to ensure you're compliant.

When should I consider hiring an accountant?

If you find accounting overwhelming, or if your business finances become complex, it's a good idea to consult a professional.

Can I manage my accounting without software?

Yes, but software can automate many tasks, making the process more efficient and accurate.

Register For The VIP Club Now To Lock In

Charter Member Pricing For The Life Of Your Membership!

Free Membership

VIP Club

Annual Membership

Today Only $347

VIP Club

Monthly Membership

Today Only $37 / Month

Here's What Others Are Saying About Syncnet...

⭐️⭐️⭐️⭐️⭐️

I Went from 12 to 240+ Cakes in a Single Year

I was able to get around 12-14 wedding cakes a year with word of mouth, but Syncnet implemented an online marketing strategy that included upgrading my website and getting traffic to it and my business exploded 1200% in a single year. I now have steady clients and I can be booked out as far as 8 months! I couldn't handle any more business than I have now!

Joan B.

⭐️⭐️⭐️⭐️⭐️

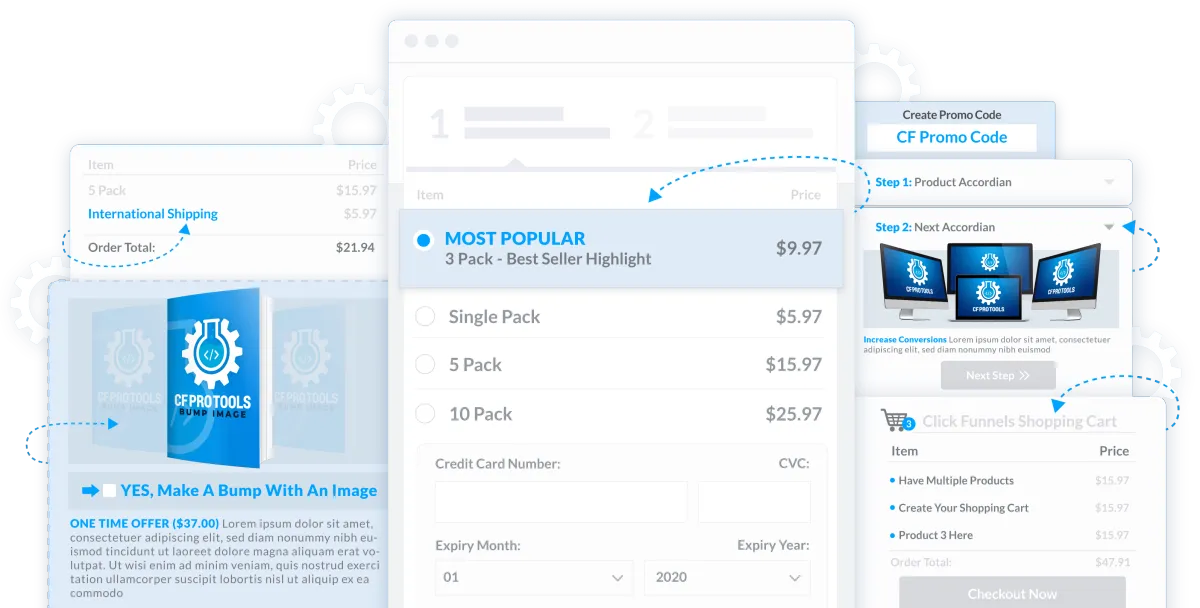

More Than Doubled Our Landing Page Signups

Syncnet helped us take our webinar registrations and templatize a system to produce a large number of landing pages for all of our events and did it for such a low price. I'll never leave as a client. They know their stuff! It's a fantastic service!

Mark K.

⭐️⭐️⭐️⭐️⭐️

WE DID IT! We are an official Corporation!

Thank you again For The S-Corp template. We were able to file with the feds and state and now I have a legitimate corporation! It saved me at least $500 if I had used an attorney or maybe even more!

Jess M.

⭐️⭐️⭐️⭐️⭐️

Best Session of the Entire Conference...

Colin recently presented what I thought was the best conference session of the entire week at the NACVA/CTI Business Valuation & Financial Litigation Hybrid & Virtual Super Conference. I immediately put into place several of the action steps that he recommended during his session...

Michael D. Pakter, Forensic Accounting Expert

⭐️⭐️⭐️⭐️⭐️

Colin has a wealth of great information! He loves helping people succeed & exudes affable energy!

Janae Castell, CVA, MAFF

⭐️⭐️⭐️⭐️⭐️

Passive Income For The Win

Syncnet helped us sell over 500 copies of our audio clips. As a musician, we didn't have a clue as to how to sell online but Syncnet showed us the way and now we have passive income that has allowed us to set it up and forget about it.

Gerek A.